All Categories

Featured

Table of Contents

The settlement may be spent for development for an extended period of timea solitary premium deferred annuityor invested for a short time, after which payout beginsa solitary premium instant annuity. Single costs annuities are typically funded by rollovers or from the sale of a valued property. A flexible costs annuity is an annuity that is planned to be moneyed by a collection of settlements.

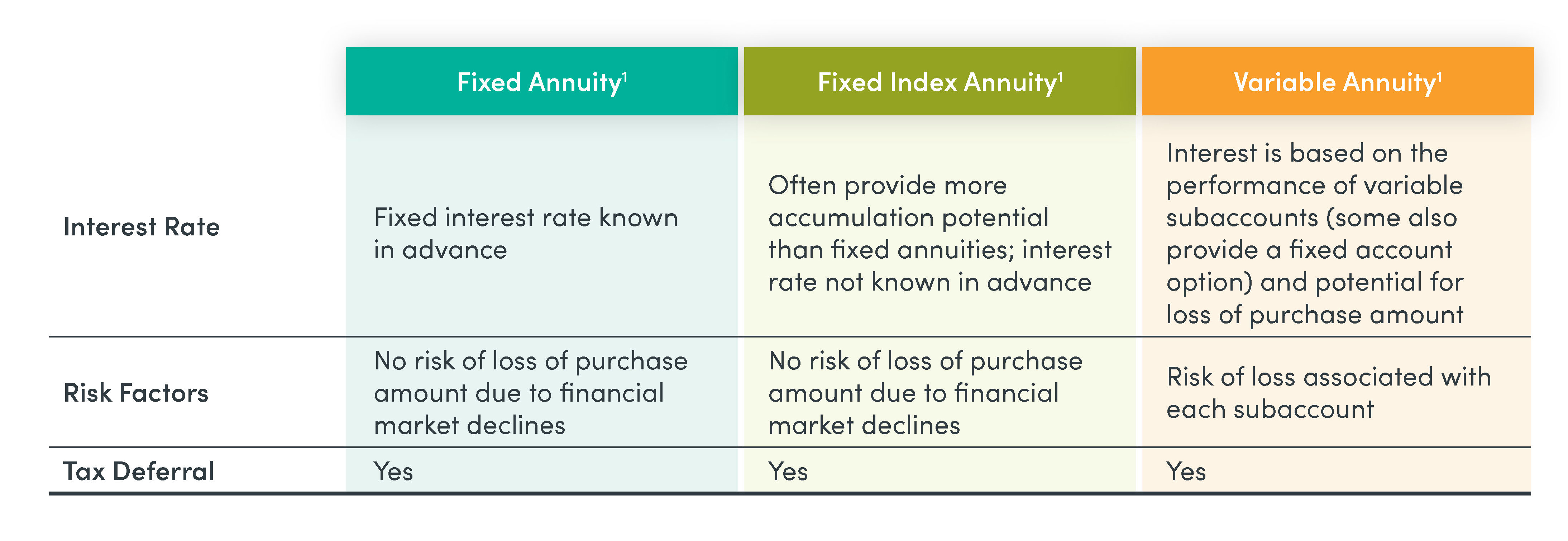

Owners of dealt with annuities recognize at the time of their purchase what the worth of the future capital will be that are generated by the annuity. Certainly, the number of money flows can not be known ahead of time (as this relies on the contract proprietor's lifespan), but the guaranteed, taken care of rate of interest at the very least gives the owner some level of assurance of future income from the annuity.

While this distinction appears straightforward and uncomplicated, it can dramatically influence the value that an agreement owner inevitably stems from his/her annuity, and it develops significant uncertainty for the contract proprietor - Variable annuity investment options. It likewise normally has a product influence on the level of costs that an agreement proprietor pays to the providing insurer

Set annuities are frequently utilized by older financiers who have actually restricted possessions but who wish to offset the danger of outliving their assets. Fixed annuities can act as an effective device for this objective, though not without specific disadvantages. As an example, when it comes to prompt annuities, as soon as an agreement has actually been bought, the agreement owner relinquishes any kind of and all control over the annuity properties.

Decoding Fixed Indexed Annuity Vs Market-variable Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Fixed Vs Variable Annuities Advantages and Disadvantages of Different Retirement Plans Why Fixed Annuity Or Variable Annuity Is a Smart Choice How to Compare Different Investment Plans: Simplified Key Differences Between Annuities Variable Vs Fixed Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Annuity Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Retirement Income Fixed Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Variable Vs Fixed Annuities A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

An agreement with a normal 10-year surrender period would charge a 10% abandonment charge if the contract was given up in the initial year, a 9% surrender charge in the second year, and so on until the surrender charge gets to 0% in the agreement's 11th year. Some delayed annuity agreements consist of language that permits for little withdrawals to be made at numerous periods throughout the abandonment duration scot-free, though these allocations typically come at an expense in the form of reduced surefire rate of interest.

Equally as with a fixed annuity, the owner of a variable annuity pays an insurance provider a swelling amount or series of repayments in exchange for the promise of a collection of future repayments in return. As discussed over, while a taken care of annuity grows at an assured, consistent rate, a variable annuity expands at a variable price that depends upon the efficiency of the underlying investments, called sub-accounts.

Throughout the buildup phase, assets spent in variable annuity sub-accounts expand on a tax-deferred basis and are tired just when the contract owner takes out those incomes from the account. After the buildup stage comes the income phase. In time, variable annuity properties should theoretically boost in value until the contract owner chooses she or he would like to begin withdrawing money from the account.

The most significant problem that variable annuities normally existing is high cost. Variable annuities have numerous layers of charges and costs that can, in accumulation, develop a drag of up to 3-4% of the agreement's value each year.

M&E expenditure costs are computed as a percentage of the agreement worth Annuity providers pass on recordkeeping and other administrative costs to the agreement proprietor. This can be in the kind of a level annual cost or a portion of the agreement value. Management charges might be consisted of as component of the M&E danger fee or might be assessed individually.

These fees can vary from 0.1% for passive funds to 1.5% or even more for actively taken care of funds. Annuity contracts can be tailored in a number of methods to serve the particular requirements of the agreement owner. Some common variable annuity motorcyclists consist of guaranteed minimal buildup benefit (GMAB), assured minimum withdrawal benefit (GMWB), and ensured minimal revenue benefit (GMIB).

Breaking Down Your Investment Choices Everything You Need to Know About Variable Annuity Vs Fixed Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Variable Annuity Vs Fixed Indexed Annuity Is Worth Considering How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Risks of Fixed Vs Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Retirement Income Fixed Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Retirement Income Fixed Vs Variable Annuity A Beginner’s Guide to Fixed Annuity Vs Equity-linked Variable Annuity A Closer Look at Fixed Vs Variable Annuity Pros Cons

Variable annuity contributions give no such tax obligation deduction. Variable annuities often tend to be very inefficient vehicles for passing wide range to the future generation because they do not delight in a cost-basis change when the original contract owner dies. When the proprietor of a taxed financial investment account passes away, the expense bases of the financial investments held in the account are gotten used to mirror the market prices of those investments at the time of the proprietor's fatality.

Such is not the instance with variable annuities. Investments held within a variable annuity do not obtain a cost-basis change when the original proprietor of the annuity passes away.

One significant concern associated with variable annuities is the potential for problems of passion that may feed on the part of annuity salesmen. Unlike an economic expert, that has a fiduciary duty to make investment choices that benefit the customer, an insurance broker has no such fiduciary obligation. Annuity sales are highly profitable for the insurance experts who sell them due to high upfront sales payments.

Several variable annuity contracts consist of language which puts a cap on the percent of gain that can be experienced by certain sub-accounts. These caps prevent the annuity proprietor from totally taking part in a part of gains that could or else be appreciated in years in which markets generate considerable returns. From an outsider's point of view, it would certainly seem that capitalists are trading a cap on financial investment returns for the aforementioned ensured floor on financial investment returns.

Understanding Fixed Income Annuity Vs Variable Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: A Complete Overview Key Differences Between Variable Vs Fixed Annuity Understanding the Rewards of Long-Term Investments Who Should Consider What Is A Variable Annuity Vs A Fixed Annuity? Tips for Choosing Fixed Vs Variable Annuities FAQs About Variable Vs Fixed Annuities Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Fixed Vs Variable Annuities A Beginner’s Guide to Fixed Indexed Annuity Vs Market-variable Annuity A Closer Look at Variable Vs Fixed Annuities

As noted above, surrender costs can significantly limit an annuity owner's capacity to relocate possessions out of an annuity in the very early years of the contract. Further, while most variable annuities enable contract owners to withdraw a defined amount throughout the accumulation stage, withdrawals past this amount normally result in a company-imposed cost.

Withdrawals made from a set interest rate financial investment option could also experience a "market worth change" or MVA. An MVA readjusts the value of the withdrawal to show any changes in rates of interest from the moment that the cash was spent in the fixed-rate option to the moment that it was taken out.

On a regular basis, also the salespeople that sell them do not totally understand how they work, therefore salesmen in some cases take advantage of a purchaser's emotions to offer variable annuities rather than the merits and suitability of the products themselves. Our company believe that capitalists must totally recognize what they own and just how much they are paying to own it.

However, the exact same can not be said for variable annuity assets held in fixed-rate investments. These properties legitimately belong to the insurer and would as a result go to danger if the firm were to fall short. Any assurances that the insurance coverage business has actually agreed to offer, such as an assured minimal revenue benefit, would be in concern in the occasion of an organization failing.

Breaking Down Fixed Vs Variable Annuities A Comprehensive Guide to Investment Choices What Is Fixed Vs Variable Annuities? Pros and Cons of Fixed Vs Variable Annuity Pros Cons Why What Is Variable Annuity Vs Fixed Annuity Is Worth Considering Fixed Annuity Vs Variable Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Rewards of Deferred Annuity Vs Variable Annuity Who Should Consider Pros And Cons Of Fixed Annuity And Variable Annuity? Tips for Choosing Variable Annuity Vs Fixed Indexed Annuity FAQs About What Is Variable Annuity Vs Fixed Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Interest Annuity Vs Variable Investment Annuity A Closer Look at Variable Annuity Vs Fixed Annuity

Prospective purchasers of variable annuities should understand and consider the monetary condition of the providing insurance policy company prior to getting in into an annuity contract. While the benefits and disadvantages of various types of annuities can be disputed, the genuine concern surrounding annuities is that of viability.

As the saying goes: "Customer beware!" This short article is prepared by Pekin Hardy Strauss, Inc. ("Pekin Hardy," dba Pekin Hardy Strauss Riches Monitoring) for informative purposes only and is not intended as an offer or solicitation for company. The info and information in this write-up does not make up legal, tax, audit, financial investment, or other expert recommendations.

Table of Contents

Latest Posts

Analyzing Fixed Vs Variable Annuity Pros And Cons A Comprehensive Guide to Variable Vs Fixed Annuities Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Annuity Vs Variable Annuity W

Analyzing Strategic Retirement Planning A Comprehensive Guide to Pros And Cons Of Fixed Annuity And Variable Annuity Defining the Right Financial Strategy Pros and Cons of Various Financial Options Wh

Highlighting the Key Features of Long-Term Investments A Closer Look at Fixed Annuity Or Variable Annuity Breaking Down the Basics of Tax Benefits Of Fixed Vs Variable Annuities Benefits of Fixed Inde

More

Latest Posts